The U.S.-China trade war keeps escalating—Washington just slapped 145% tariffs on Chinese goods, and Beijing fired back with 125% on American imports. But beneath the surface, a far more consequential battle is brewing over rare earth elements (REEs). These obscure metals might seem insignificant, but they’re the backbone of everything from AI and defense systems to clean energy and global tech supply chains.

Tariffs disrupt trade today. Rare earths dictate who dominates tomorrow. Their importance makes them a strategic asset—and a powerful weapon—in the unfolding geopolitical and economic rivalry between the world’s two largest economies.

Why Rare Earths Matter

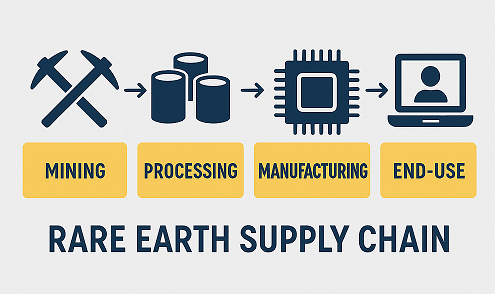

REEs are a group of 17 metals critical for cutting-edge technology. Smartphones, electric vehicles, guided missiles, AI chips—they all rely on these materials. Despite their name, they’re not actually rare geologically. The challenge lies in mining and refining them efficiently.

China controls 60–70% of global REE production and a staggering 85–90% of refining capacity. Decades ago, Western companies abandoned the sector due to cost and environmental concerns, leaving the U.S. dependent on Chinese supply chains. That dependence is now a glaring vulnerability.

From Trade War to Tech War

So far, the trade war has revolved around tariffs and manufacturing. But rare earths give China an asymmetric advantage—a way to strike back without matching tariffs dollar for dollar.

Should Beijing decide to restrict or embargo key REEs like neodymium (used in electric motors), U.S. industries could face material shortages, production delays, and spiraling costs. That pressure would ripple across sectors—automotive, aerospace, clean energy, and especially defense. Elon Musk’s Tesla, Space X and AI companies as well as Lockheed Martin and Apple would be hit hard.

China’s recent move to add seven REEs to its restricted dual-use list—materials with both civilian and military applications—signals a shift. While not an outright ban, it’s a clear step toward weaponizing supply chains. Last year, China blocked exports of gallium, germanium, and antimony to the U.S. after a tit-for-tat escalation. The same playbook could unfold here.

The U.S. is scrambling to rebuild its rare earth capabilities. The Pentagon is backing refining projects, and California’s Mountain Pass mine is being revived. But progress is slow. Developing alternative supply chains takes years—time the U.S. might not have if tensions keep rising.

The Stakes Are Higher Than Tariffs

Tariffs on steel or microchips inflate prices and reroute supply chains, but their impact is short-term. Rare earths are different. They underpin the future—AI, quantum computing, green energy, and next-gen military tech. Control over REEs means control over innovation itself.

If this becomes a battle over techno-industrial containment, the trade war will morph into something darker. The question won’t be about balancing imports and exports. It’ll be: Can we cripple the other side’s ability to develop the next AI chip, drone fleet, fusion reactor or just the next breakthrough?

The Global Scramble

Allies are stepping up. Australia, Canada, and Vietnam are boosting production. The EU is mapping rare earth projects, and recycling tech is gaining traction. Ukraine, believed to sit on vast REE reserves, could become a key supplier—though the war complicates near-term prospects.

Wildcards like Africa’s untapped deposits, deep-sea mining, or Taiwan’s overlooked reserves might shift the balance. But none of these solutions are quick fixes. China’s dominance won’t fade overnight.

A New Cold War?

If the trade war intensifies, rare earths could pivot the conflict from tariffs to outright containment. The U.S. and its allies might build parallel tech ecosystems, while China tightens its grip on BRICS+ and Belt and Road partners. The result? A fragmented global system and a full-blown techno-industrial Cold War.

Rare earths aren’t just commodities anymore. They’re strategic assets—and potential weapons. Over the next year, they could move from the shadows to center stage, reshaping global power dynamics.

Rare earths are the 21st-century oil, the control of which means power over tech/defense. Whoever controls the rare earths may not just win the trade war—but define the next era of technological and geopolitical leadership. They don’t just reflect today’s friction—they could define the shape of global power in the next decade

=================================

Jamal Ashley Abbas is a media and energy specialist, writer, and advocate for integrating AI and sustainable solutions in global development. He writes on technology, geopolitics, and the intersection of innovation and power, among other topics.

*********************************************

If you liked the post, please subscribe

or donate, if you can, through Paypal or GCash;

so I can continue maintaining this blog.

Check the sidebar =====>>

Thanks.

**********************************************